For millions of American, student debt is more than a temporary burden; it’s a detriment to their economic and personal well-being. According to the Federal Reserve, the central bank of the United States, over half of all young adults who attended college incurred debt to fund their education. Among them, 20% fell behind on their payments. Individuals who did not complete their degrees or attended for-profit colleges are more likely to struggle with debt repayment than those who complete degrees from non-profit schools, including students who took on large amounts of debt. Furthermore, borrowers who were first-generation college students or black or Hispanic are more likely to be behind on loan repayment than borrowers with a parent who completed a bachelor’s degree or who are white.

Federal Reserve research also finds that as college tuition rates increase and student loan debt rises, home ownership among American households falls. Because student loan repayments eat up significant portions of borrower’s income, threaten credit scores, and make saving money difficult, it’s unsurprising that over 80% of 22 to 35 year old educational debt holders who’ve not bought a house say student loans keep them out of the housing market. As long as student debt prevents young educational borrowers from owning homes, it limits their ability to build wealth. Alongside this outcome, student debt creates other far-reaching hardships like inability to save for retirement, inability to donate to charity, decline in credit score, failing job-related or rental housing-related credit checks, delays in starting a business, delays in getting married, delays in having children, and stress.

Candidates for the 2020 U.S. presidential election are responding to the student debt crisis with an array of policy proposals, including loan refinancing and debt cancellation. While such ideas may appeal to millions contending with student loan repayment, they don’t address the root of the problem. Even if current student loans were forgiven, the next generation of learners stand to incur future debt in the absence of systemic change to tuition rate setting and financial aid provision in higher education. To help catalyze this change, the Michelson 20MM Foundation has awarded a Spark Grant to the Hildreth Institute.

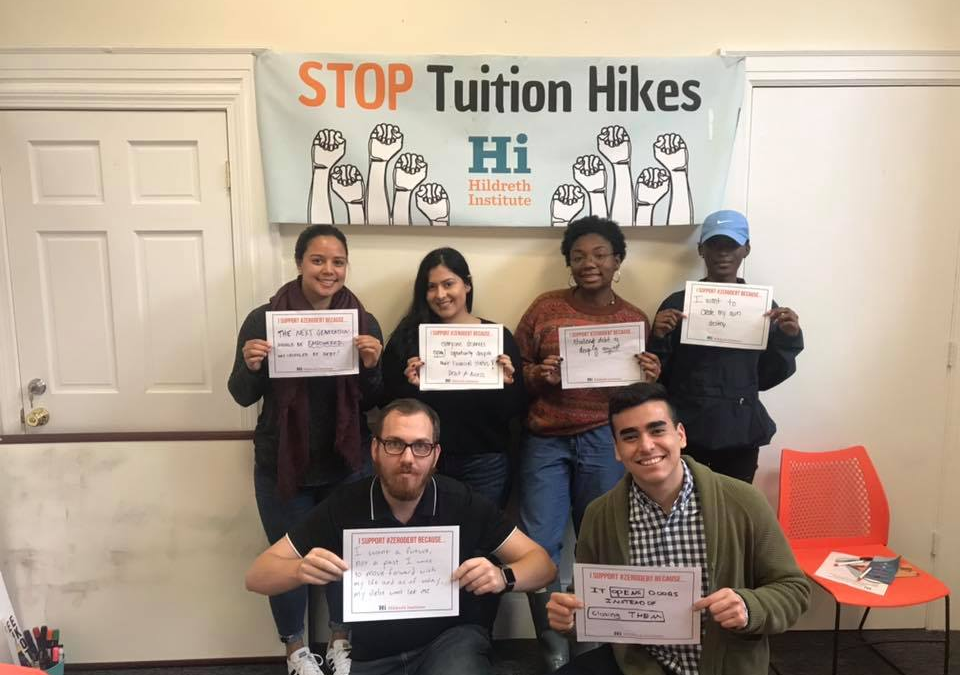

Founded in 2018, the Hildreth Institute conducts research to develop and promote policy solutions to the college affordability crisis. The Institute is a key member of a new, broad-based coalition of Massachusetts nonprofits, students, and elected officials that recently launched an ambitious, three-year advocacy campaign to help students obtain degrees from high-quality, public Massachusetts universities without going into debt. Tentatively named, “Zero Debt Massachusetts,” this multifaceted campaign will encompass development of evidence-based, data-driven policy solutions, grassroots organizing, educating policy makers, and mobilizing students and families across the state to demand major changes in college financing. The first stage of the campaign aims to advance policy proposals in the Massachusetts legislature.

To further this work, the Spark Grant will fund a research report that outlines the “Zero Debt College” model and proposes policy recommendations for the “Zero Debt Massachusetts” coalition to pursue with the state legislature. We hope that this report and the policy actions taken in Massachusetts inspires coalitions of stakeholders in other states to enact similar measures.

Tuition at Massachusetts public universities is the eight highest in the nation. The average graduate of a Massachusetts public university, who took out a student loan, left school with $30,200 in student loan debt in 2016. From 2004 to 2016, per capita debt (including those students without loans) increased by 122 percent, from $9,900 to $22,000. This issue is one that impacts the equity of our educational system. Studies show that student debt disproportionately burdens low- and middle-income households, blacks, Latinos, and women.

The Hildreth Institute report will provide the coalition the analysis necessary to craft a Zero Debt program with eligibility requirements to ensure disadvantaged populations benefit the most. Currently, the majority of existing college affordability programs, such as need-based grants or free-tuition programs, have eligibility requirements that restrict access for students with need. One such example is a requirement to be a full time student. These requirements can have the unintended consequence of reinforcing inequity, because

- Students who attend part-time undergraduate degree programs in Massachusetts are much more likely to be low-income than students attending full-time programs.

- Larger percentages of Black/African-American and Hispanic/Latinx undergraduates in Massachusetts attend college part time.

- College affordability income caps do not take net worth into consideration, though data show that a typical middle-income White family had a net worth 3.4 times the typical middle-income Hispanic/Latinx family, and four times the typical middle-income Black/African-American family. Among students made ineligible for a funding guarantee by income caps, White students are still far more likely to access their families’ wealth to pay for college than students of color.

Unlike existing tuition-free, debt-free, or Promise programs, a Zero Debt program recognizes that loans are not true financial aid as long as they must be repaid. A Zero Debt program’s goal is to provide grant support aimed at eliminating need to borrow. Rather than providing free tuition for all students, a Zero Debt program offers a progressive structure in which students able to pay for college cover their costs while students who would otherwise take out loans are covered by a new grant. The Hildreth Institute’s research will be critical in determining how to define ability to pay and need to borrow, based on a combination of income and wealth. The Zero Debt coalition’s objective is to develop and promote a novel policy to solving the student debt crisis. The Hildreth Institute’s research, supported by the Spark Grant, will help achieve that goal.

While a growing number of states adopt Promise scholarships or free tuition programs, However, few initiatives address eliminating the need to borrow. The Hildreth Institute’s report will thus

- Synthesize existing scholarship on Promise programs to better understand student eligibility, program beneficiaries, and effect on college affordability

- Examine the impact of programs open to part-time students and develop an understanding of how to create initiatives inclusive of non-traditional students

- Review the few existing programs and proposals designed to eliminate or reduce the need to borrow, in an effort to better understand how these programs define unmet needs and calculate educational costs beyond tuition and fees

The Michelson 20MM Foundation and its initiatives are made possible by the generous support of Gary K. Michelson, M.D. and his wife, Alya Michelson.

We will be conducting Phase 3 of the Michelson Spark Grant program in Q1 of 2020. To learn more please visit our webpage or sign up for notifications via the form below.